Transforming Industrial Manufa...

- 2025-12-01

A Manufacturer's Perspective on Q1 Procurement Strategy

Author: Alex Lyon (Manager at High Fasteners)

Date: December 29, 2025

Read Time: 12 Minutes

Introduction: The Calm Before the Storm?

If you were sourcing industrial fasteners in 2025, you probably felt like you were riding a roller coaster—one that kept changing speed without warning. We saw iron ore prices bounce around like a ping pong ball thanks to mining policies in Australia and Brazil, watched energy surcharges shoot up in manufacturing hubs like a rocket, and navigated the choppy waters of global logistics like seasoned sailors.

Now that we're wrapping up 2025 and peering into the First Quarter of 2026, every procurement manager seems to be asking me the same thing:

"Alex, should I lock in my orders now, or wait for the price to drop after the New Year?"

It's a million-dollar question, no doubt about it. I don't have a crystal ball, mind you, but I do have 20 years of data from the production floor in Handan—the beating heart of China's fastener industry. And that data? It's telling us a story that's surprisingly specific.

This isn't your run-of-the-mill market report. We're going deep here—looking at how Steel, Energy, and Logistics will collide in Q1 2026, and what that collision means for the cost of your Hex Bolts and Anchors.

Raw Material Inventory at High Fasteners factory. Strategic stockpiling is key to stabilizing prices for our clients.

Part 1: The 2025 Retrospective – What Just Happened?

To understand where we're heading, we need to look at the mess we just left behind. That's just common sense, right?

2025 was the year the global steel market felt the heat of "Decarbonization Pressure." Steel mills in China and India found themselves facing stricter environmental regulations than ever before.

The Result?

Reduced output of low-grade steel and a noticeable shift towards Electric Arc Furnaces (EAF).

The Impact on Fasteners?

The premium for Cold Heading Quality (CHQ) steel wire—the specific stuff we use to make bolts—stayed stubbornly high. Unlike structural steel (rebar), CHQ steel requires precise annealing and spheroidizing. You can't just grab any old scrap metal and turn it into a Grade 12.9 bolt, believe me.

Throughout Q4 2025, we saw a slight dip in demand as global construction slowed down for winter. But don't let that fool you. The underlying costs—Labor + Energy—haven't gone down one bit.

Part 2: 2026 Q1 Forecast – The Bullish Signals

Looking at the futures market and our mill suppliers' quotations for January and February 2026, we're seeing a "Bullish" trend—prices are likely to rise. Here's the breakdown by factor.

1. Iron Ore & Scrap Steel: The Foundation

Iron ore prices have stabilized around the $120-$130/ton mark as we exit 2025. However, steel mills typically restock heavily right before the Chinese New Year (which falls in mid-February 2026).

Historically, this pre-holiday rush drives raw material prices up by 5-8% in January.

My Prediction? Expect raw material costs for Carbon Steel (Q235, 35K, 45K) to tick upward starting January 15th, 2026. Mark my words.

2. The "Nickel" Effect on Stainless Steel

If you're buying SS304 or SS316 bolts, you need to keep a close eye on the Nickel index. In late 2025, we saw some real volatility in the Indonesian nickel supply chain.

For Q1 2026, analysts predict a tightening of Class 1 Nickel supply. This means the "Alloy Surcharge" for stainless steel fasteners will likely increase. If you have a large project requiring Stainless Steel expansion anchors, the price you see today is likely the floor, not the ceiling. That's just how it is.

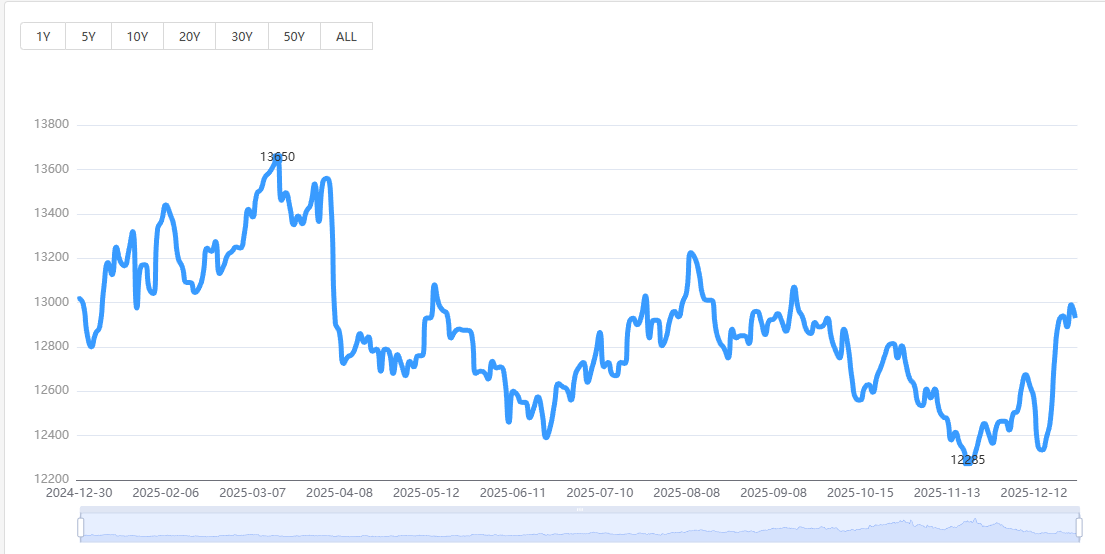

Projected Steel Price Index Trend for Q1 2026. Data based on industrial futures analysis.

Part 3: The "Hidden" Costs: Processing & Energy

Many buyers make a rookie mistake—they track the Iron Ore Index and assume Bolt prices will follow it 1:1.

It doesn't work that way, folks.

A bolt is 40% raw material and 60% processing. Let that sink in.

Drawing & Annealing: Requires massive amounts of electricity.

Heat Treatment: Requires natural gas or electricity.

Plating (Zinc/HDG): Requires chemicals and strictly regulated wastewater treatment.

In 2026, industrial electricity costs in manufacturing hubs are forecasted to rise by roughly 3% due to green energy transition policies. Furthermore, environmental audits usually tighten in Q1 before the major political meetings in March. This limits the capacity of plating factories.

The "Old Hand" Insight:

When plating capacity drops, lead times double. Even if steel gets cheaper, if you can't get your bolts galvanized, you can't ship them. In Q1, capacity will be king. Trust me on this.

Heat Treatment Furnace at High Fasteners. Energy costs are a significant driver of final fastener pricing.

Part 4: Impact on Specific Fastener Categories

Not all bolts are created equal, you know. Here's how the 2026 trends will hit different product lines:

1. Standard Hex Bolts (DIN 933 / DIN 931)

Trend: Stable to Slight Increase (+3%).

Reason: Inventory levels are healthy, but replacement stock cost is rising. The fierce competition keeps prices in check, but margins are thin—real thin.

2. High Strength Structural Bolts (ASTM A325 / A490)

Trend: Moderate Increase (+5-8%).

Reason: These require Alloy Steel (Boron or Chrome-Moly). Alloy additives are getting more expensive by the day. Plus, the heat treatment process for Grade 10.9/12.9 is energy-intensive—no two ways about it.

3. PTFE / Xylan Coated Fasteners (B7 Studs)

Trend: Steady.

Reason: The cost driver here is the coating process and the specialized Fluorocarbon material. While the steel base might fluctuate, the premium nature of this product buffers the volatility. However, lead times may extend due to high demand from the offshore sector restarting projects in Q1. That's just the reality.

Part 5: The Logistics Wildcard

We can't talk about cost without talking about shipping, can we?

In 2025, we saw freight rates stabilize after the chaos of previous years. But entering 2026, shipping lines are practicing "Blank Sailings"—canceling voyages—to keep prices artificially high before the Chinese New Year.

Warning for Importers:

Shipping containers from China to US/Europe in late January to early February 2026 will face a "Peak Season Surcharge."

If your order isn't ready to ship by January 20th, you might be paying $1,000+ extra per container, or waiting until late February. That's a tough pill to swallow, but it's true.

Global logistics remain the X-factor in landed costs. Planning shipments before CNY is critical.

Part 6: My Strategic Advice for Procurement Managers

I've been in this industry long enough to see the cycle repeat itself—more times than I can count. Based on the data above, here's my honest advice for your Q1 2026 strategy:

1. The "Early Bird" Strategy (Recommended)

Place orders before January 15th.

Why?

You lock in the current raw material price before the pre-holiday hike.

You secure production slots before the factories close for Chinese New Year (CNY).

You avoid the logistics bottleneck in February.

It's simple logic, really.

2. The "Blanket Order" Strategy

If you have a recurring need for standard items (like DIN 933 M12x40), sign a Blanket Order now for Q1 and Q2 delivery.

At High Fasteners, we allow clients to lock in prices for 3-6 months if they commit to volume. This insulates you from the Q1 fluctuations. It's a win-win situation.

3. Don't Compromise on Quality for Pennies

When steel prices tick up, some smaller workshops will start "cheating" on the wire rod quality—using non-standard steel—or skipping the tempering process. You know the ones I'm talking about.

Do not fall for the "too good to be true" low price in Q1. It usually means the mechanical properties (Tensile Strength) won't meet ISO standards. That's a recipe for disaster.

We use Optical Sorting Machines to ensure every batch is perfect, regardless of raw material cost pressure. Quality is in our DNA.

Quality is non-negotiable. Our Optical Sorting Machine ensures 0-PPM defects even during peak production cycles.

Conclusion: Partnering for Stability

2026 will be a year of "Recovery and Realignment." While we don't expect the crazy spikes of the pandemic era, the days of "cheap, bottom-dollar" steel are gone—gone for good. The market is maturing, and quality compliance is becoming stricter by the day.

As a manufacturer, my job isn't just to make bolts; it's to help you navigate these trends so your supply chain doesn't break. That's what partnership is all about.

Key Takeaway:

Raw Material: Upward trend in Jan/Feb.

Energy/Processing: Cost increasing.

Action: Secure stock now to cover the Q1 production gap.

If you need a detailed quote or want to discuss locking in pricing for your 2026 projects, my team and I are ready to help. We're here for you.

Let's build something strong together in 2026.

Contact the Factory Direct:

High Fasteners (Handan Hangfan Metal Products Co., Ltd.)

Website: www.highfasteners.com

Email: admin@changhua-electrical.com

Tel: +86 0310 6611199

Factory Location: Yongnian District, Handan City, China